PRE CLOSING

Understanding the homeowner long-term success is of critical importance to us. Our mortgage planners will analyze your present situation including income, tax bracket, savings, your future long-term and short-term goals, and affordability. From this information, we will develop solutions best fitted for your goals.

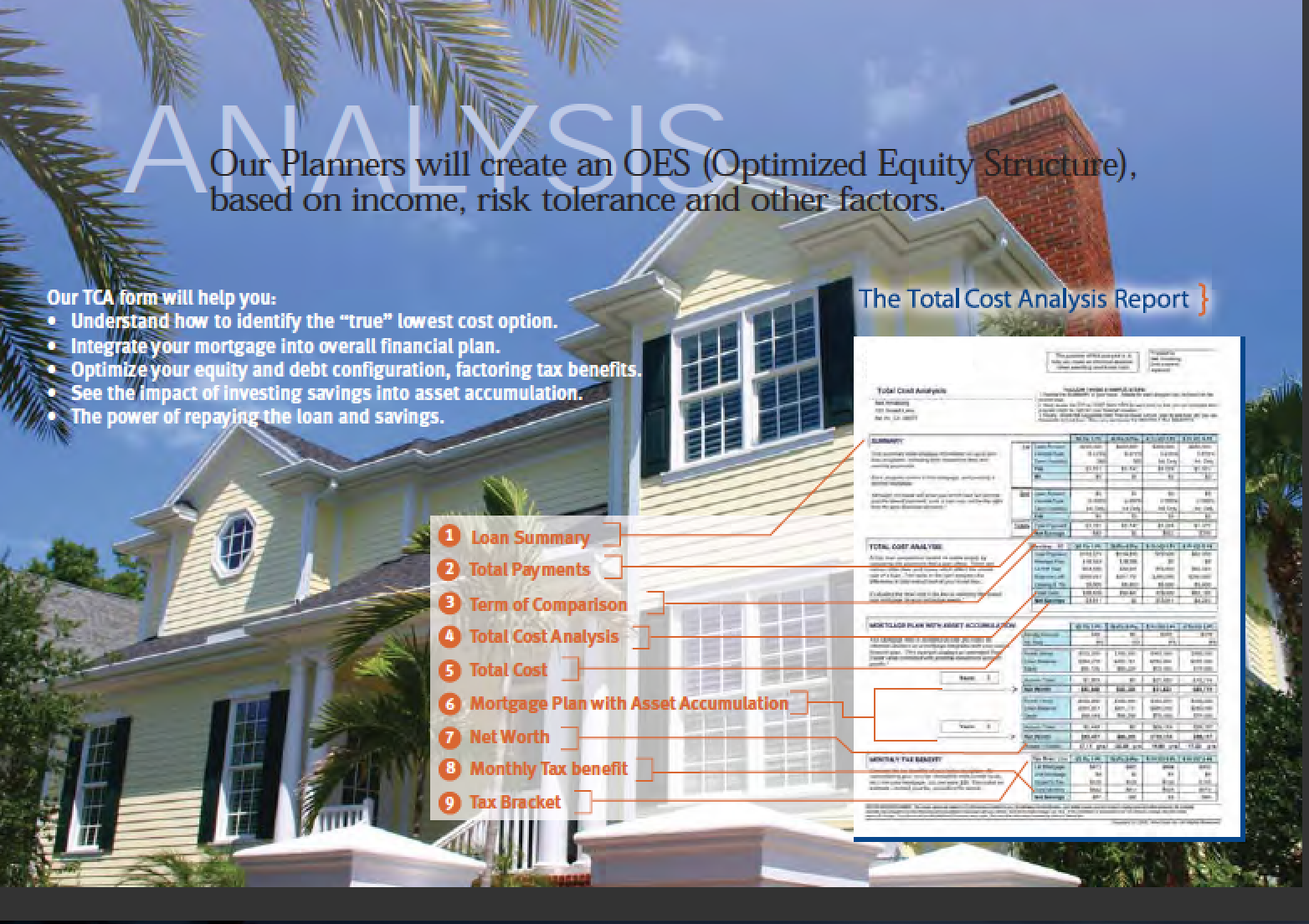

Throughout the process, we will provide you with illustrated reports using state-of-the art software and technology.

Our report performs the industry’s most powerful side-by-side analysis of the net cost of a loan over time. It will compare up to four loan options allowing you to see loan amounts, total monthly payments, principle paid, total interest cost, total closing cost, tax savings (please see your CPA or other tax advisor for specifics) and loan balance at the end if the term.

- Demonstrates how making extra payments will effect the loan over time

- Understand how to identify the lowest cost option

- Estimates your real estate value combined with potential investment account growth

- View detailed picture of the life of the loan

- Compare the after-tax benefit of early pay-down to that of equity investment

- See how to invest the money you save, by securing a new loan, and protecting your investment

Freedom Point

It is the point in time when homeowner’s assets exceed their debts. Traditionally is reached when homeowners pay off their mortgage and own their home free and clear. However, our report maps out how you can reach this magic moment faster by selecting mortgage programs with lower payments while investing the difference into an asset accumulation account.

We use Total Cost Analysis Report, Consolidation Analysis Report, and Average Weighted Interest Rate for Pre-Closing Reports.